Goldman Sachs Hedge Fund Concentration Index (GSTHHVIP and GSTHVISP)

In an article named

published on zerohedge.com website on 12/19/2021. It asks a good question whether it's time to chase the laggards in the stock markets now. One of laggards (i.e., it has performed very poorly lately) mentioned in the article is:

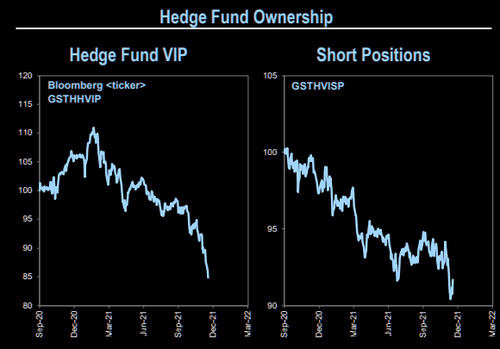

hedge fund concentration (i.e., GSTHHVIP and GSTHVISP)

Note that if a stock is on the "VIP" list, it means that a lot of hedge funds own it and if a stock on the "Most shorted" list, it means that a lot of hedgies hate it.

|

| Figure 1. GSTHHVIP vs GSTHVISP (Source: Goldman Sachs) |

Goldman Sachs Hedge Fund VIP Index

In [1], it describes the methodology for the Goldman Sachs Hedge Fund VIP Index:

The Goldman Sachs Hedge Fund VIP Index (the “Index”) is owned by Goldman Sachs Asset Management L.P. (the “Index Sponsor”). The Index is calculated by Solactive AG (the “Calculation Agent”).

The Index consists of hedge fund managers’ “Very-Important-Positions,” or the US-listed stocks whose performance is expected to influence the long portfolios of hedge funds. Those stocks are defined as the positions that appear most frequently among the top 10 long equity holdings within the portfolios of fundamentally-driven hedge fund managers.

The Index is rebalanced on a quarterly basis to reflect changes in reported hedge fund manager holdings.

You can read a tutorial on Goldman Sack's Financial Series to learn how to interact with financial data series. It'll walk through some examples of how to retrieve and visualize market data in order to analyze the performance of different assets.

Goldman Sachs Very Important Short Positions For Hedge Fund

Reported on 01/28/2021 by Barron's, it describes GSTHVISP as the below:

Goldman Sachs publishes a report that looks at the holdings of 814 hedge funds with $2.4 trillion of gross equity positions.

As of the start of the fourth quarter 2020, the most recent report available, 10 of the stocks Goldman calls “very important short positions” for hedge funds with the highest short interest included:

- C.H. Robinson Worldwide (CHRW)

- Advanced Micro Devices (AMD)

- Aon (AON)

- Duke Energy (DUK)

- Analog Devices (ADI)

- Kroger (KR)

- Simon Property (SPG)

- Hormel Foods (HRL)

- Willis Towers Watson (WLTW)

- Chipotle Mexican Grille (CMG).

Note that high short interest is, essentially, a high percentage of total shares available for trading borrowed and sold by bearish investors betting on price declines. It can exacerbate a stock’s price rise in a short squeeze because investors like hedge funds, who for the most part are active short sellers, have to buy more shares to cover bets as losses mount.

Comments

Post a Comment