Investment―Stagflation 2.0

|

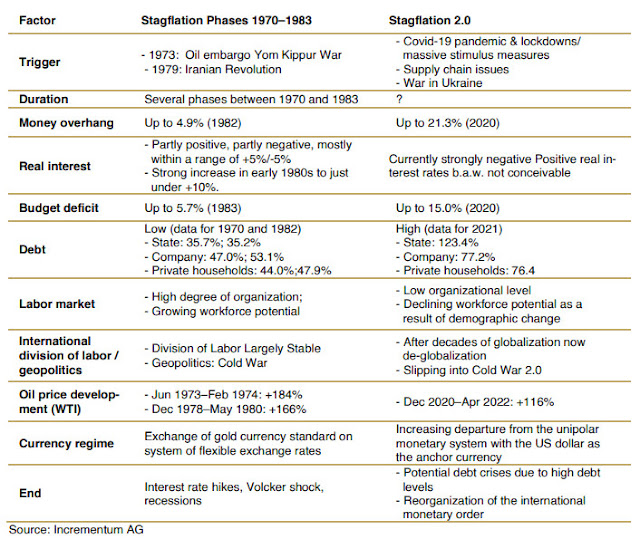

| Table 1. Stagflation 1.0 (1970-1983) vs 2.0 |

Stagflation, or recession-inflation, is an economic phenomenon marked by persistent high inflation, high unemployment, and stagnant demand in a country's economy.[1]

During a particularly severe period of economic conditions in the 1970s, rising inflation and slumping employment put a damper on economic growth in the United Kingdom and seven other major market economies, and investors in equity markets suffered greatly as a result.Historically, the last pronounced stagflation phases occurred between 1970 and 1983. These were made possible by a liquidity overhang, which had its origins in an excessively loose monetary policy, and were triggered by oil shocks caused by geopolitical tensions.[2]

Stagflation 2.0

In its "In Gold We Trust" report, incrementum (i.e., a fund and asset management firm) believes we're in another period of stagflation and minted the term "stagflation 2.0".

We will certainly not have to endure a repeat of the stagflation of the 1970s; rather, we’ll see stagflation 2.0, with its numerous peculiarities.

In table 1, you can view its comparison between Stagflation (1970-1983) and Stagflation 2.0. You can also read [2] for more details.

Comments

Post a Comment