Technical Analysis—Two Indexes Highly Correlated to $SPX

|

| Figure 1. US Finanaical Asset Managers & Rydex Bull/Bear Asset Ratio (Source: @SuburbanDrone) |

Rydex Bull/Bear Asset Ratio

!RYRATMM is

- Rydex Asset Ratio - Bear + MM Assets/Bull Assets (NBD)

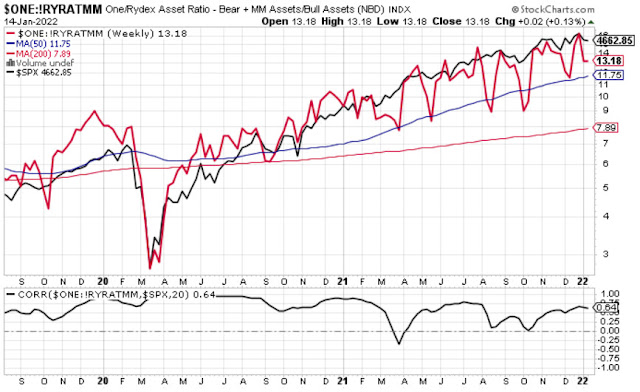

$ONE:!RYRATMM is the inverse of !RYRATMM (or 1 / !RYRATMM) , which represents:

- Rydex Bull/Bear Asset Ratio

As show in Figure2, 1/!RYRATMM (red) and $SPX (black) have high positive correlation.

|

| Figure 2. Relation between 1/!RYRATMM (red) and $SPX (black; Source: stockchart.com) |

US Financial Asset Managers

As show in Figure 3, $DJUSAG (red) and $SPX (black) have high positive correlation.

Figure 4. Margin Debt (Source: @MFHoz)

Comments

Post a Comment