|

| Figure 1. Energy spikes preceded almost every recession |

Below indicators will not try to time when the recession will come. But, just add them to your prediction tool chest for monitoring purpose:

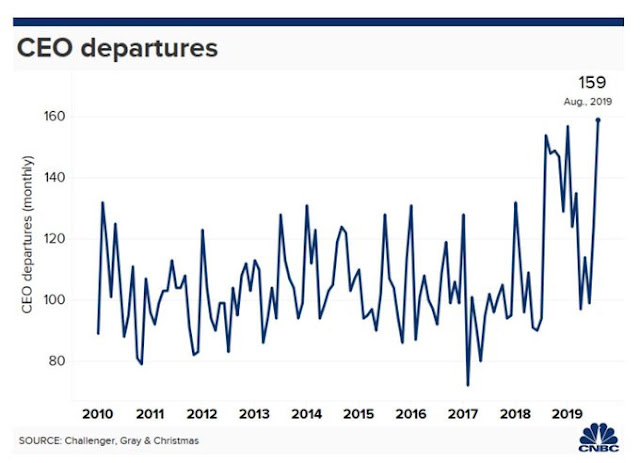

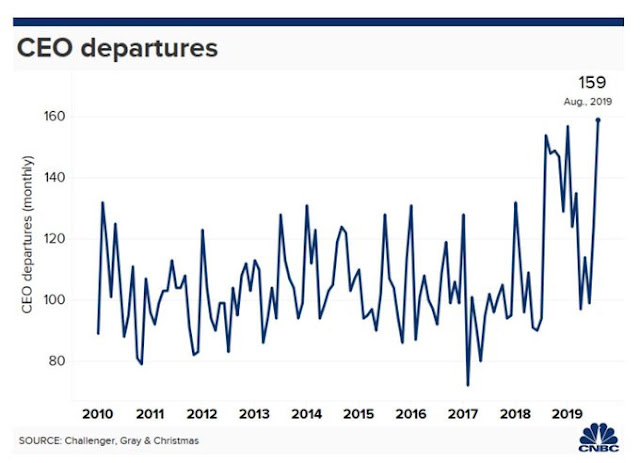

- CEO departures

- Bank layoffs[3,8,9]

- Heavy truck sales in the US are down

- This is one of the metrics Lyn Alden Schwartzer watch, because it tends to be a leading recession indicator.[2]

- Inverted yield curve[2,4]

- IPO trouble[2,4]

- Some of these failed IPOs are another log on the recession risk bonfire, because now bondholders are at risk, employees are at risk, investors are starting to tone down their enthusiasm, etc.[2]

- High oil prices

- Energy spikes preceded almost every recession for the last 80 years.[10]

|

| Figure 1. CEO departures tend be higher before the recession |

References

- An Interesting Recession Indicator

- The Music Is Winding Down, But Opportunities Exist

- HSBC to cut up to 10,000 jobs in drive to slash costs: FT

- Inverted Yield Curve , Recession, and Market Top

- Fundamental Analysis—Renaissance IPO Index

- Propositions For A Recessionary Bear Market

- The reason our Recession Warning Composite focuses on psychologically driven variables like stock prices, yield spreads, credit risk, and purchasing manager surveys is that few measures of "hard" economic activity reliably lead recessions.

- By the time a U.S. recession begins, stocks have typically been in a bear market for months.

- Market tops are created because investors stop looking for a top, and simply extrapolate good news as a permanent feature of the economic landscape. Similarly, market bottoms are created because investors stop looking for a bottom, and extrapolate ongoing bad news.

- The Relentless Road To Recession Continued

- Global bank job cuts this year push past 70,000 mark. (Bloomberg)

- Morgan Stanley is cutting jobs due to uncertain global environment, sources say

- Another Strange Recession

Comments

Post a Comment