Financial Markets and the Business Cycles

Updated on 06/08/2024

This Signal Flashed "Recession" For 22 Months Straight (YouTube link)

By October, TLT plunged 50% from its July 2020 peak, then rebounded 20% by year-end 2023. This year, inflation worries pushed TLT down 10%.

Original Post

Bull Market

A bull market normally goes up in 5 waves and has 3 phases:

- Smart money moves in

- Smart money guys — who are not market timers, they’re value finders

- Institutional money moves in

- Public moves in

- Wall Street will provide the story to catch everybody's attention and public money moves to the market

Market Topping

Market topping is a process which normally includes different asset classes peaking in a specific sequence. Using tech bubble as an example:

- Bond market peaked in 1999

- Stock market peaked in early 2000

- Stock market historically peaks an average of seven months before every recession

- Commodity market peaked in fall 2000

A bear market is normally triggered by the following series of events:

- Inflation rises

- Interest rate rises

- Oil price rises

- Fed hikes rate

|

| Figure 1. Bond peaked in July 2016 |

Current Business Cycle

For this business cycle, we have already seen:[8]

- Bond peaked in July 2016

- US Dollar peaked in Jan 2017

- Oil bottomed in Feb 2016

- Consumer and Producer prices bottomed last Summer

- Commodity prices are rising

- Wages are rising

- Rising inflation which have caused bond yields rising

Based on Financial Sense, it predicts that the economy could begin to slow down probably the end of 2018 or the beginning of 2019. However, economists from both ECRI and ITR Economics are saying that this coming recession would be mild or brief because we still have:

- Tax cuts as a tail wind

- New government spending

- 300 billion dollars are coming in as an economic stimulus through government spending

- New infrastructure spending

- Trump's still working on a trillion dollars infrastructure programs.

So, Financial Sense has said that this coming recession could be more like the one we had seen in 2001, but not like in 2007.[8]

Figure 2. US Dollar peaked in Jan 2017

Figure 3. Oil bottomed in Feb 2016

Figure 5. Household % of Disposable Income vs Personal Saving Rate

What to Expect at Stock Market Top?

When stock market peaks, you should see the following transitions happening:[8]

- Sector strength rotated from Consumer Discretionary to Consumer Staples

- Sector strength rotated from from Technology and Consumer Discretionary to Energy and Material

- Precious Metal start rising

|

| Credit: @market_sleuth |

References

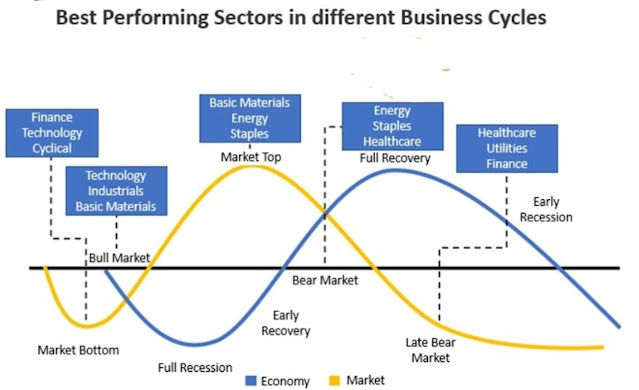

- Sector Rotation Analysis (Business Cycle)

- In the Words of Dr. Seuss's The Lorax, "Unless..."

- What Is the Gold-to-Silver Ratio Saying About Emerging Markets?

- When commodity prices fall

- Value Stock Outperformance May Indicate Stronger Economy Ahead

- Why It Matters That Value Stocks Are Outperforming Growth Stocks

- The Darkening Skies

- The Final Phase Will Be an Epic Battle

- Economic Patterns - Part 2: Road To The 2001 Recession

- Who Thinks This Recession Is Over?

- 5 Reasons Why Commodities Are the Place to Be in 2018

- What's next for US stocks?

- "This market's current temperament feels so much like either Japan in 1989 or the United States in 1999. And the events that have transpired so far this January make me feel more convinced than ever of this repeating history," hedge fund great Paul Tudor Jones wrote in a note to clients.

- Inflation, General Data Flow, Fiscal Stimulus, And Implications For Monetary Policy

- Commodities: It's The Year Of The Bull

- Commodities prices react to many factors including fundamentals and technical issues:

- On the fundamental side, demographics point to more people in the world with more money competing for raw materials, which are finite assets.

- At the same time, technical factors point to capital looking for a home as stocks are at high valuations and bonds appear to be moving lower.

- What Are Indicators Saying about a Potential Recession?

- Take the Long Way Home: Economic Expansion Gets a Boost (Charles Schwab)

- Higher inflation and tighter monetary policy tends to signal late-cycle conditions; and tends to be accompanied by higher equity market volatility.

- Volatility spikes don’t tend to signal finales to expansions; but they do tend to signal late-cycle conditions.

- Spikes in volatility have not historically signaled the end of business cycles; however, 60% of the spikes outside of recessions occurred during the late stages of the cycle.

- JPMorgan Co-President Sees Possible 40% Correction in Equity Markets

- JPMorgan Chase & Co. executive Daniel Pinto warned equity markets could fall as much as 40 percent in the next two to three years.

- Summers Warns Next U.S. Recession Could Outlast Previous One

- The next U.S. recession could drag on longer than the last one that stretched 18 months. That’s the assessment of former Treasury Secretary Larry Summers.

- Trends For New Home Sale Prices At The Beginning Of 2018

- Anticipating Anticipation

- Adam breaks down these groups as follows, from earliest trend spotters to later adopters:

- Metal traders (earliest trend spotter)

- Bond traders

- Equity Traders

- Oil Traders

- Currency Traders

- Economists

- Central Bankers (last adopter)

Comments

Post a Comment